When you’re running a business, sometimes things go wrong. Whether it’s adverse weather, an accident or an IT failure, events can easily derail your ability to carry on business as usual.

A business continuity plan (BCP) is a strategy that outlines how your small business will operate when things go wrong.

What is a business continuity plan (BCP)?

A business continuity plan is a set of documents that set out formal steps to follow in the event of a major disruption to your business.

The plan is designed to help your business to keep operational and will outline what needs to be done, and who needs to do it, in a range of scenarios. This will give your customers, partners and employees reassurance in your company’s ability to withstand unexpected events.

Why is business continuity planning important?

A business continuity plan means that when a crisis hits, your business already knows what needs to be done, and by whom. The plan will usually outline key responsibilities for ensuring that staff, customers and premises are protected.

This is important because responding quickly to an event means there is less chance your customers, partners and employees will be negatively affected.

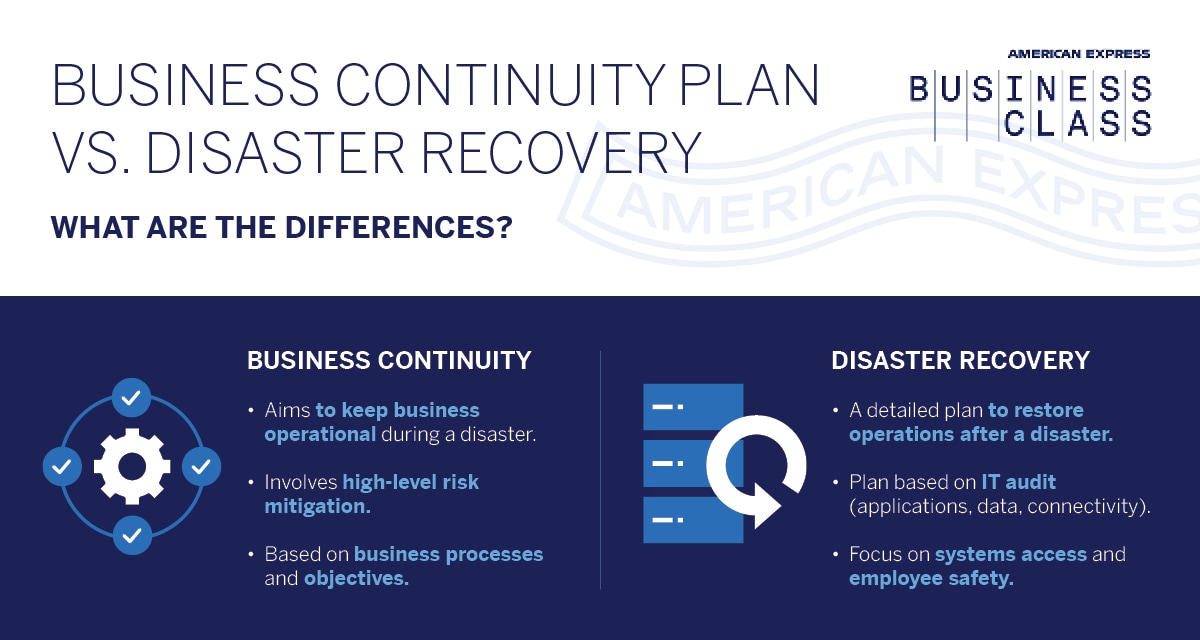

Business continuity plan vs disaster recovery plan

Simply put, business continuity is a plan for how to avoid catastrophe, but disaster recovery is the plan that you use when a catastrophe has happened.

A business continuity plan will take a high-level view of risk avoidance and mitigation and consider how to maintain minimum service levels in the event of a problem. However, a disaster recovery plan is a specific policy that details how to contain problems and recover from them after they have happened.

|

What are the components of a business continuity plan?

According to Jean-Marc Chanoine, Global Head of Strategic Accounts for business document company Templafy, your business continuity plan should be based on the type of risk faced. "That means you should have one plan in case certain ownership is incapacitated and another plan in case of a physical disaster," he says. "Each risk has its own set of issues and ways to approach those problems so the business can continue to operate.”

With that in mind, there are two main components to a business continuity plan:

1. Roles and responsibilities of your team

"Who's on your succession team?" asks Chanoine. "Did you hire a lawyer that has experience in assuring that you have the right legal documentation in place in case of your incapacitation? That includes what happens for a change of ownership. Because oftentimes, small businesses are partnerships. If one person [steps back], there's usually something in place that says the other owners will be able to buy them out. You've got to have your accountant, lawyer and key managers ready."

Equally important are job responsibilities and communication. According to Sean Chou, CEO of Catalytic, an app that automates business continuity plans using AI, these documents must shed light on exact roles and functions that need fulfilling. Plans should clarify job responsibilities as well as outline new safety measures to keep workers protected.

“In the plan, owners should document which individuals are responsible for safeguarding and recovering every function of the organisation – from the most critical to the most routine tasks – and describe the responsibilities of that function in the order of importance,” says Chou.

It’s also important to ensure all documentation is current, accessible, and clear. This includes key components of a business continuity plan, such as recovery time objectives (RTOs). The RTOs define the number of days necessary to restore business functionality and avoid material disruption after the occurrence of a disruptive event.

2. Backup and security basics

Named, trusted employees will be critical during a disruptive event or your incapacity. These staff members should be cross-trained in the critical functions of the business.

The trusted employee needs easy access to important functions and assets like bank accounts and payroll. Using a password vault, along with a set of encoded files, gives the employee the information they need while keeping this confidential information secure until it’s required.

The plan should also detail where backups of critical information are kept, and how they can be accessed in an emergency. For example, is there a copy of employee contact details that can be accessed outside the office? If your server room has flooded, how should the IT team get back-up servers up and running? Where are your insurance documents stored, and who can access them if the physical document is damaged by fire?

An important element of scenario planning is considering how the situations you’re planning for might impact your cash flow. Flexibility can be vital, which is why the American Express® Business Gold Card provides payment terms of up to 54 days¹ which helps give you peace of mind when planning for all scenarios and events.

How to create a business continuity plan

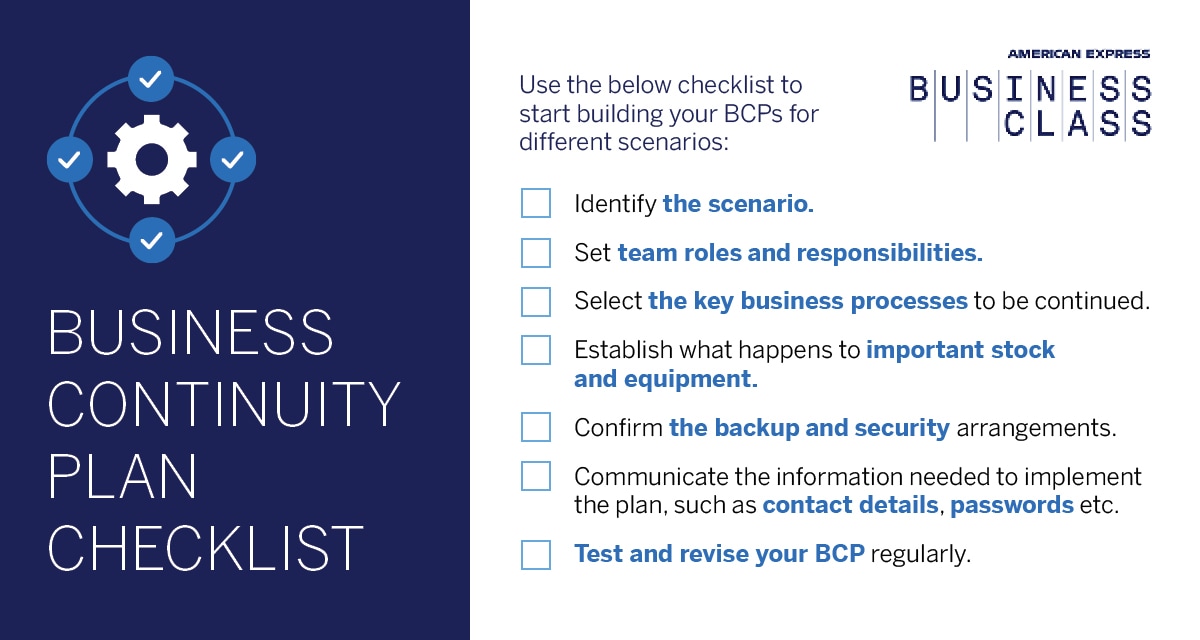

The first step in creating a business continuity plan is to understand what risks it is helping to mitigate. While no business continuity plan can cover every possible threat to the business, it should be comprehensive enough to consider scenarios such as adverse weather, incapacitation of key people in the business, loss of access to premises, and loss of access to data.

For each of these scenarios, your business continuity plan should provide a checklist or summary plan that outlines the scenario, how the business will respond to that scenario and a timeline for recovery.

|

It’s important that a business continuity plan is written in simple language and can be easily understood in high-stress situations.

The benefits of a business continuity plan

One of the primary benefits of having a plan in place is that it lets you train your team. You can run the scenarios that may befall your company, to train your staff on how to operate in a crisis.

Chanoine recommends doing a trial run of your plan and treating this is an important part of keeping your business safe.

Another benefit of effective business continuity plans is how they can help businesses carry out operations with speed and efficiency. Chou recommends leveraging automation to quickly activate the continuity plan when needed. That way the owner can focus on the human elements involved in surviving a crisis, such as inspiring team members or reassuring customers through regular communication. He says his team automated its own plan to speed up how it communicates procedures and instructions in a crisis.

Finally, a crucial part of business continuity planning is to make sure your business continuity plan is reviewed regularly. Over time, staff members leave, processes change and contact details are updated. Your business continuity plans could fail if a disaster happens and the person who is responsible for getting things up and running has left the business. Experts advise reviewing a BCP at least once a month.

1. If you'd prefer a Card with no annual fee, rewards or other features, an alternative option is available – the Business Basic Card. The maximum payment period on purchases is 54 calendar days and is obtained only if you spend on the first day of the new statement period and repay the balance in full on the due date.